Choosing the right Pillar 3 pension, or indeed getting to grips with the complexities of the Swiss Pillar pension system, can seem daunting. To help, we’ve pulled together questions we are asked about Pillar 3. We hope this helps you understand the key elements and considerations within the system but if your question isn’t answered, let us know.

Will my employer contribute?

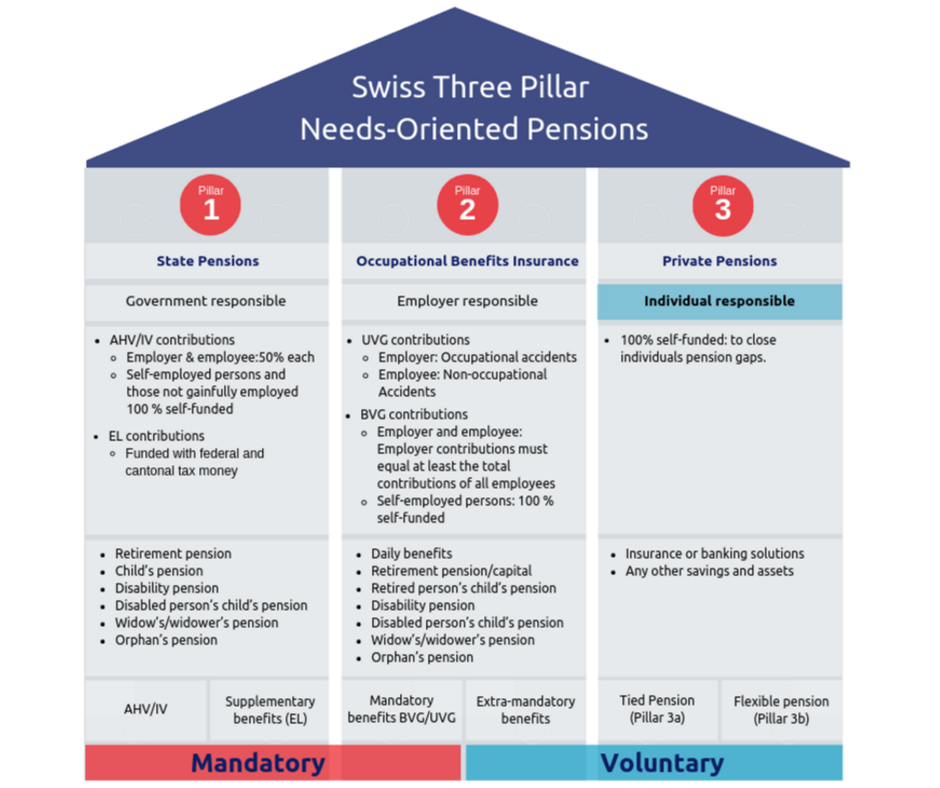

No. A Pillar 3 pension is 100% privately funded. The 2nd pillar is the mandatory pension for employer contributions. We show this in more detail in the graphic below.

However, this does come with certain advantages. You can claim back the income tax on any sum you pay into your Pillar 3a account, up to the maximum annual allowed level of CHF 6,826 (as of 2020).

For my 3rd pillar, should I pick a bank or insurance provider?

On arriving in Switzerland the majority of expats start 3rd Pillar pension contributions through their bank. This is mostly, but not always, by default. It is relatively straight forward to set up and contributions can be paid directly from your current account.

Both options are great for your private pension and generating tax savings. The crux comes down to finding the product best suited to your specific requirements. For each, you should have the choice of an interest-based return or an investment in securities. This is why it is important to consider your attitude to risk prior to selecting your Pillar 3 pension.

Banks, on the whole, will offer an interest-based account. This might be slightly higher than your typical savings account. The rates are likely to be relatively low but you get more flexibility around how much you put in each month. Should you decide to open your Pillar 3 with a bank in Switzerland, it is worth comparing the different interest rates that are offered.

A Swiss Pillar 3 pension managed by insurance companies tends to offer lower interest rates over longer periods. However, like any investment in funds, there is the opportunity to increase investment value and benefit from dividends. An insurance provider will also commit you to regular payments. This can be an excellent way to ensure you consistently contribute to your personal pension and build up wealth to enjoy in your retirement.

If you are looking to increase your savings whilst in Switzerland, we have created a free downloadable guide to help you develop great saving habits. You can download your copy HERE.

The main advantage of an insurance provider is that they best protect your pension. This means that if you have an accident or pass away before being able to take your pension they will pay the sum to your beneficiary. If you have moved to Switzerland with a partner it is important to have an honest discussion about your retirement and plan your Swiss Pillar 3 together.

Wait, I’m a frontalier! Can I still open a 3rd Pillar pension?

Yes, if you are a frontalier who is a quasi-resident. If 90% of your household income is earned in Switzerland then you are a quasi-resident. This means that you can apply for certain Swiss tax deductions such as commuting expenses and payments to your 3rd Pillar pension.

Pillar 3a, Pillar 3b pension, what’s the difference?

As you can see from the picture below, the Swiss pension system is built on three pillars. You can learn more about the system and each of the pillars in our detailed blog.

Pillar 3 is your personal private pension and these schemes are voluntary. The last of the pillars is used by expats and Swiss nationals alike to supplement their income in retirement.

Swiss tied Pillar 3a pensions are long-term plans where capital is locked into a retirement plan. Flexible Pillar 3b pensions are plans that do not have a prescribed term, where the capital is available at any time.

There is always a trade-off with each of the Swiss pillars. Your Pillar 3b pension payments are fully flexible, but the Pillar 3a system has far more tax advantages. The government allocates a Pillar 3a allowance each year.

One of the critical differences between the Swiss Pillar 3a and Pillar 3b is that the capital tied up in a Pillar 3a pension is not available to you until maturity, whereas capital invested in a Pillar 3b scheme is available to you at any time.

What are the benefits of the Pillar 3a pension?

Pillar 3a is the only one of the pillars where payments are tax-deductible. The tax savings can go up to CHF 2,000 annually. Additionally, money available at maturity is not taxed as regular income but at a special rate, which the Swiss government generally reviews and adjusts every two years.

When planning your Swiss Pillar 3 it is important to think about what is likely to happen in the future. Are you planning to stay in the area? Or do you need full flexibility because you are unsure of your future?

Do tax benefits depend on which canton I live in?

Tax benefits are linked to your household income for the canton in which you reside, so it will vary from canton to canton. Income tax brackets are cantonal, not national.

As a guide, you will receive back the benefits as a % of your tax-deductible income, so the higher you are taxed the more you are incentivised to deposit the maximum into Pillar 3a as it will be refunded.

You can use a calculator to get an idea of the Swiss tax reductions you are likely to benefit from.

What happens if I’m ill and can’t fulfil my contributions?

A Swiss third pillar pension can be used to fill in the gaps in your second pillar pension should you become ill. As a Pillar 3 is your private Swiss pension, you have more flexibility than you would with a State Pension or Occupational Benefits Insurance.

What restrictions come with a Swiss Pillar 3?

There are no restrictions on financing but there are limits to how much you can put in your Swiss Pillar 3a annually. Because of the tax benefits for a Pillar 3a, the investment is capped at CHF 6,826 (2019 and 2020) for employees with an existing pension fund. However, you can invest any sum over this in your Swiss Pillar 3b.

What happens to my Pillar 3 pension if I leave Switzerland?

Normally, you would only withdraw your money from your Swiss Pillar 3a on retirement. However, there are a few circumstances that allow you to withdraw money before this.

These specific conditions are:

- buying or building a primary residential property

- moving abroad permanently

- setting up your own business.

As an expat, the ability to withdraw your funds should you leave is one of the main advantages of your Swiss Pillar 3a pension. It means you can still benefit from the tax advantages but you can withdraw your investment when you leave Switzerland.

With regard to your Swiss Pillar 3b, you will be taxed on withdrawals. The tax is calculated separately from your other income and is at a lower rate. However, there is also a one-off tax you will need to consider.

What matters most is contributing to your pension

It may be that a Swiss Pillar 3 pension solution is not right for you and your circumstances. Expats who are not going to be in Switzerland may choose another investment structure as part of their retirement plans. The most important factor is to commit a percentage of your salary each month towards your retirement.

We are all living longer and there are few countries where the state pension will be sufficient to cover a good quality of life. Company pensions are a welcome support to state pensions, but can also be a victim to scandals and misuse. Having a private pension is the best way to secure the future lifestyle you want for you and your family.