In the financial world, when someone asks, “what’s your number?”, it’s likely they are not trying to fix a date with you. Rather, they want to know your financial independence number.

A financial independence number tells you when you’re free from the need to work.

However, working out your personal financial independence number is more about what matters to you and whether you have enough money to support your ideal lifestyle.

Before you determine your personal financial number, it’s important to understand the different ways you can measure financial performance.

What is the best way to measure your financial performance?

The way we evaluate our personal financial performance is often reflective of our goals. We tend to use the method that makes us feel most comfortable about our situation. Two of the more popular methods are tracking net worth and passive income.

Net worth

An increasingly popular way to measure how financially healthy you are is to know and track your net worth. When reviewed, your net worth will give you a clear picture of whether you are spending too much, how much you have tucked away in savings and whether you’re saving enough for retirement.

Measuring your net worth is also easy to compare year-on-year. When tracked accurately, it can help you understand your financial progress over time. You will be able to determine whether you’re on track to meeting your goals.

Passive income

Passive income is the money you receive from investment assets such as stocks, bonds and real estate. When your passive income exceeds your day-to-day money needs, you no longer need to work in the traditional sense to survive financially.

For example, your net income from rental properties covers your personal costs. When it comes to stocks and bonds, you may be able to live off a percentage of your total holdings each year for a long period of time. This is how we fund retirement, we generate a passive income that is great enough to support the lifestyle we want so that we can stop working.

Calculating your financial independence number

Written as a mathematical equation, your financial independence number looks like this: investment (or passive) income > personal money needs.

That sounds simple, and it is in theory. However, translating all of your goals and dreams of your ideal lifestyle into a formula is more challenging. And keep in mind that your number will change over your life.

Your goals and expectations will change, as will your circumstances. For that reason, your financial number doesn’t have to be perfect for it to be useful in planning for your future.

Measuring your financial situation

The most important thing is that measuring your financial situation should always be consistent. That is, keep track of things like your cashflow, net worth and passive income to build a clear picture of where you are now and where you want to get to.

To do that, you need to know what short- and long-term resources are available to you (like savings, investments and property), as well as what you may need to become available in the future.

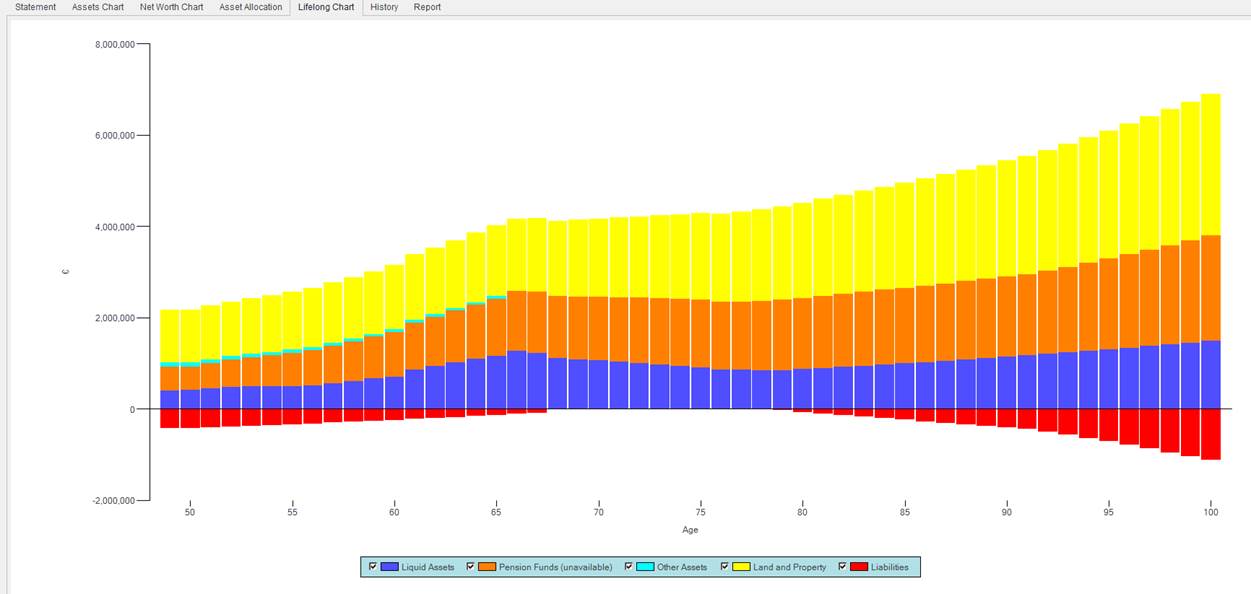

Lifestyle financial planning is a process by which you can determine what you may need in the future. It’s a process by which you can run multiple scenarios based on your current or projected situation. It allows you to see clearly your cashflow,your net worth and how much you are receiving from passive income.

It then allows you to work out how much you really need to save for your ideal future lifestyle as well as how much of your wealth you can enjoy today.

Higher isn’t always better

You may find that your financial number isn’t as simple as ‘higher is better’. In fact, you may need to reduce your net worth as you get older.

What’s right for you and your family now may well change over time, which simply means your financial independence number will also change.

This is where financial planning is more than a simple math formula: it’s a proven and robust process for ensuring the plans you make are going to get you to where you want to be financially.

Want to know your financial independence number?

Ge in touch with our lifestyle financial planning team who can help you to work it out.