An increasingly popular way to understand how financially healthy you are is to know your net worth because it is easy to track and compare year-on-year.

Net worth, when reviewed, will also give you a clear idea of whether you are spending too much, how much you have in savings and whether you’re putting enough away for retirement.

What is net worth?

It’s the value of all your assets (what you own) minus all your liabilities (what you owe). Assets include everything from cash on hand and money in your savings accounts to vehicles and property. Liabilities include any money you owe in the form of loans, credit card debt or mortgages.

Put in terms of an equation:

Net worth = assets – liabilities

In theory, your net worth is the value in cash you would have if you were to sell everything you own and clear your existing debt. When your assets exceed your liabilities, you have a positive net worth. Negative net worth is when liabilities are greater than your assets.

Why net worth is important

Many people don’t take the time to calculate their net worth yet there are many good reasons for doing so:

- It can be tracked accurately so you can understand your financial progress over time.

- Shifts the focus from income and takes into account expenses and taxes. It’s a more accurate measure of wealth.

- Debt is kept in perspective; if you have €50,000 in debt yet €200,000 in assets, your debt level isn’t extreme.

- Can help with loan applications as lenders want to know your overall financial health before they will give their approval.

Make better financial decisions

Tracking net worth over time, will show whether you are making progress toward saving, paying off debt, and meeting your financial goals. These might be short term goals, such as reducing your debt, or longer-term goals such as achieving financial independence.

There’s no ‘magic number’ when it comes to net worth. No two people are striving for exactly the same thing. Your net worth and your financial goals are just that: yours and yours alone. Just because someone you know has a greater net worth, that doesn’t necessarily mean they are happier nor more successful.

How to calculate your net worth

Calculating your net worth is really quite simple:

- Add up the total value of all your assets.

- Add up the total value of all your liabilities.

- Subtract your total liabilities from your total assets.

For most of your assets and liabilities, it’s easy to determine the value of each. For example, if you have €150,000 in savings, it’s clear that the value of that asset is €150,000. If you owe €15,000 in loans or on a credit card, the value of that liability is €15,000.

Where it becomes more difficult to determine an accurate value is with big-ticket items like property. People have a habit of over-valuing their own homes or investment properties, so subjectively value it higher than what the market says it’s worth. You don’t realise the value of your home until it is sold (and you’ve paid all the fees and taxes) so take the time to value this appropriately.

Inflating the value of any asset may look good but it’s not smart because it won’t paint an accurate picture of your net worth. It’s essential to work with either a real estate agent or property appraiser to know the value of any property you own.

Negative doesn’t mean bad

If you currently owe more than you own, don’t take it as a sign of failure or inability to manage your money. This can be a reflection of where you are in your career or it might simply be because you’ve invested in a business or home which is part of your long-term financial plan.

Positive or negative, it is always useful to know where you stand. When reviewed on an annual basis, you can determine if you are making progress towards meeting your goals or if you’re falling behind and need to make some adjustments.

Adjust your spending to save more

A key advantage of knowing your net worth is knowing how much extra money you could put towards things like your emergency fund, pensions and retirement savings. It is well known that life expectancy is increasing and that state pensions are unlikely to be able to catch up with the shortfall. Expats are often in complex pension situations due to employment contracts, nationalities and different tax jurisdictions. It might be that you are planning on funding the majority of your retirement yourself and that calculating your networth is a good measure for keeping on track.

Getting to grips with the how

A simple spreadsheet can be used to add all your assets and liabilities. Alternatively, there are apps that will calculate and track your net worth for you. Some of the most popular options are Personal Capital and Mint.

But how can you get an idea of what your net worth may be in the future? A calculating that takes into account inflation as well as the projected growth of your investments?

The best option is to work with a financial planner.

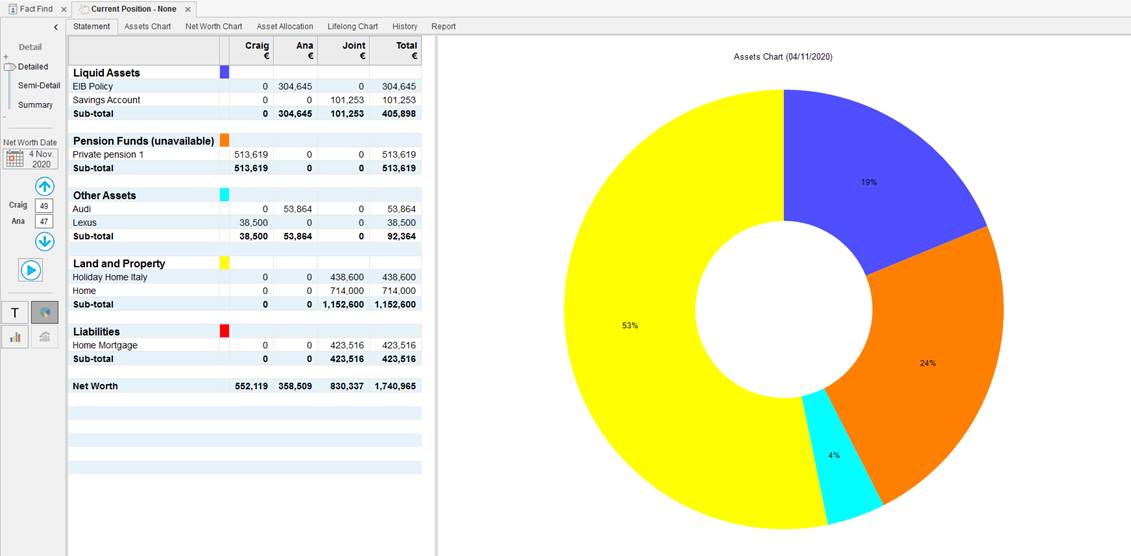

They can take all of your financial information (assets and liabilities as well as income and expenses) and use cash flow modelling software to produce a detailed net worth statement.

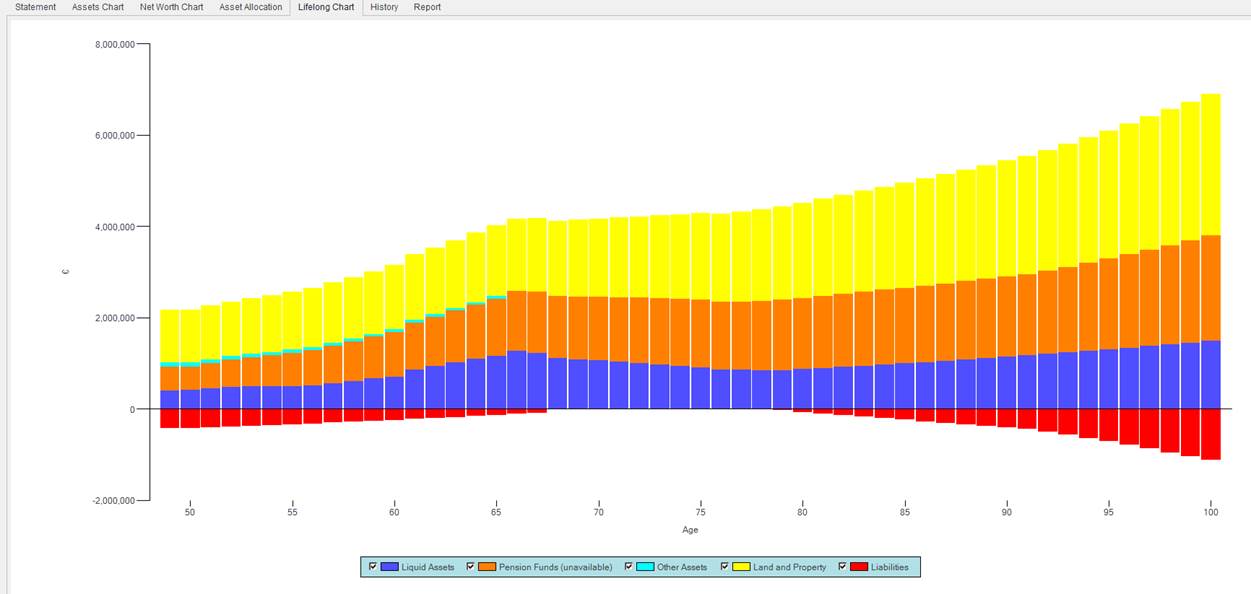

This is one of the first steps in the Lifestyle Financial Planning process. As part of this process, your financial adviser can run multiple scenarios of your possible future net worth based on your current and projected situation.

Cash flow modelling helps you visualise your financial future with easy-to-understand charts and graphs. Using computer modelling, your financial adviser can test the potential impact of life-changing events on your lifelong cash-flow forecast and possible future net worth.

Need help calculating your net worth?

Knowing your net worth is key when it comes to understanding your financial health and making sound decisions about your financial future.

If you’re short on time to fully review your assets and liabilities and accurately calculate your net worth, a financial adviser can help. Get in touch with one of our advisers today.