We know it’s never easy to think about preparing for the worst such as severe illness, disability or death. These are not topics we take lightly but they are eventualities for which we all need to prepare.

Have you thought about what would happen in the event of you falling ill and not being able to access your financial and other important information? Who would you trust to take care of financial matters on your behalf?

We encourage you to ask yourself these questions and to gather in one place the information we have listed below. You should then share this with someone you trust. If you are in a relationship, complete this information with your partner and ensure you both know how to access it and your respective accounts.

Your document check list

We advise keeping either the original versions or copies of the following in a secure place:

- bank details (access codes to all accounts including savings and investments)

- birth certificate (and marriage certificate if applicable)

- emergency contact details (legal adviser, executor of your will if applicable)

- funeral plans or wishes

- health records

- insurance policies

- investments and savings (institutional, term and access details)

- login details for email accounts (especially those linked to savings and investments)

- passport details

- pension funds

- property-related information (ownership documents, deeds)

- social security numbers (or your country equivalent)

- will (or equivalent legal document outlining your wishes in regard to assets).

The above is not an exhaustive list but it’s a good starting point for what’s important to share with your next of kin. You want to ensure, in case of the unexpected, they can access your information and make decisions on your behalf.

You can download a PDF version of the check list here: [download id=”6945″ template=”Emergency Document Check List PDF “]

Why reviewing your key documentation matters

It can be time consuming to bring all your important financial and legal information together. However, doing this has a number of benefits such as:

- you will identify any gaps and be able to sort them without being in an emotional or stressful situation

- your partner or next of kin will be fully up to date on your joint financial situation

- should the worst happen, you will be comforted by the fact you did everything possible to ease the stress of the situation on your loved ones

- you will gain peace of mind knowing that your wishes are clear and easy to follow.

During the lifestyle financial planning process with clients, we often discover forgotten pensions, missed life insurance policies or investment accounts that only one partner is aware about. We put together the above list after helping numerous expats with their financial planning.

Storing your most important information

Given your financial and legal records carry personally identifiable information, it’s wise to keep them in a secure place, such as a safe deposit box at your bank.

If you have only digital copies of certain records, make a printed copy before storing. It’s much safer as there is always a risk that your digital files could be hacked.

If it’s just not possible to keep printed copies of certain records, you will need to add to the above list the login or access details for those digital files.

For digital records, be smart and safeguard them just as you would paper records. Remember to regularly backup digital files, store them in a safe place and consider storing your back-ups in a separate location: it doesn’t make sense to keep both versions together.

There are secure password services, such as Last Pass, who offer emergency access contacts. Read their detailed blog explaining how you can manage your Digital Will and online access securely.

Being prepared

Gathering your most important financial information and appointing someone you trust to access it is just one important element of lifestyle financial planning. It gives you the confidence that whatever life throws at you, you and your family and prepared and protected.

One of the first steps on the path to financial freedom is doing an audit of your existing financial situation, including the information we’ve already talked about in this post.

From the information we gather, and using cash flow modelling, we can test the potential impact of a number of scenarios such as early retirement, ill health or premature death, on your lifelong cashflow forecast.

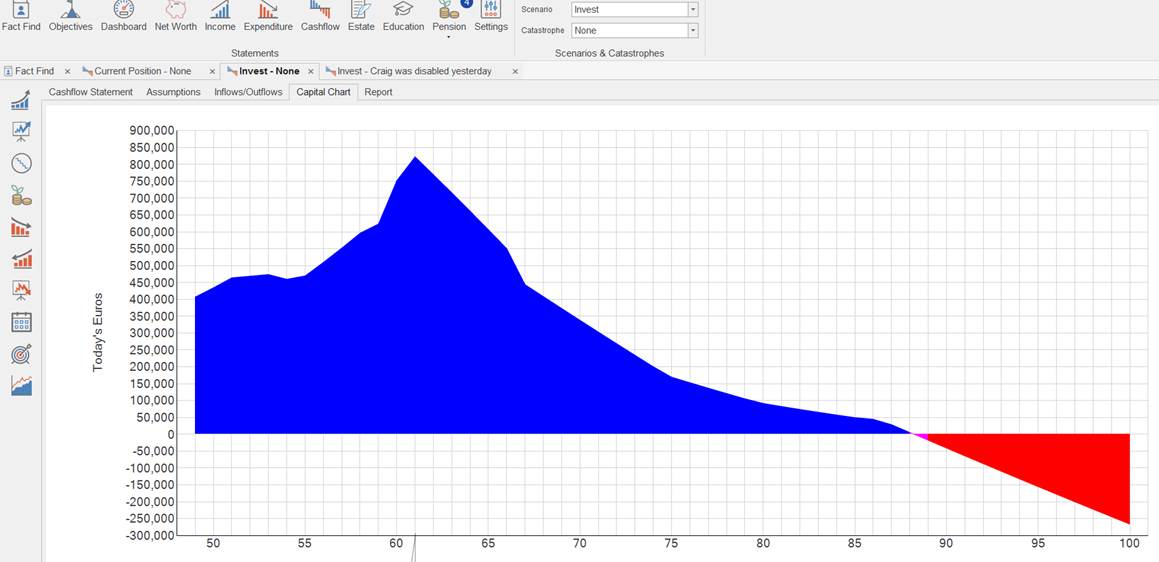

The example below shows the expected cashflow of a fictitious expat (who we’ve called Craig) who has a good and stable income:

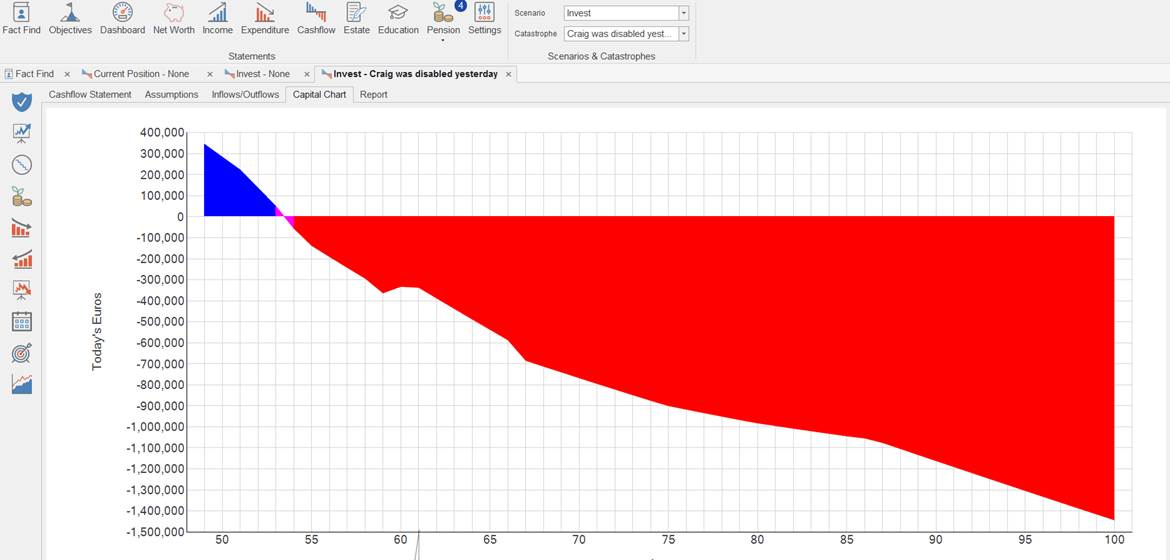

The second chart shows what happens when he is unable to work and generate the same income due to an accident:

Using projections, we can draw out the best strategies to manage risk so you can maintain your desired lifestyle through life-changing events and unexpected emergencies. For example, for Craig, it might be about introducing an insurance policy or income protection. The software allows you to see how much you’d need as a monthly income to secure your lifestyle while preventing you from paying too much or too little on your policy.

Want to know more?

If you have any questions about lifestyle financial planning or general questions about your financial situation, please get in touch with one of our financial advisers.