The good news is, we’re all living longer and, as a result, we can look forward to longer retirements. The bad news is we have to be able to fund a longer retirement. Most people generally don’t give this enough thought, and many will likely run out of money well before they run out of breath!

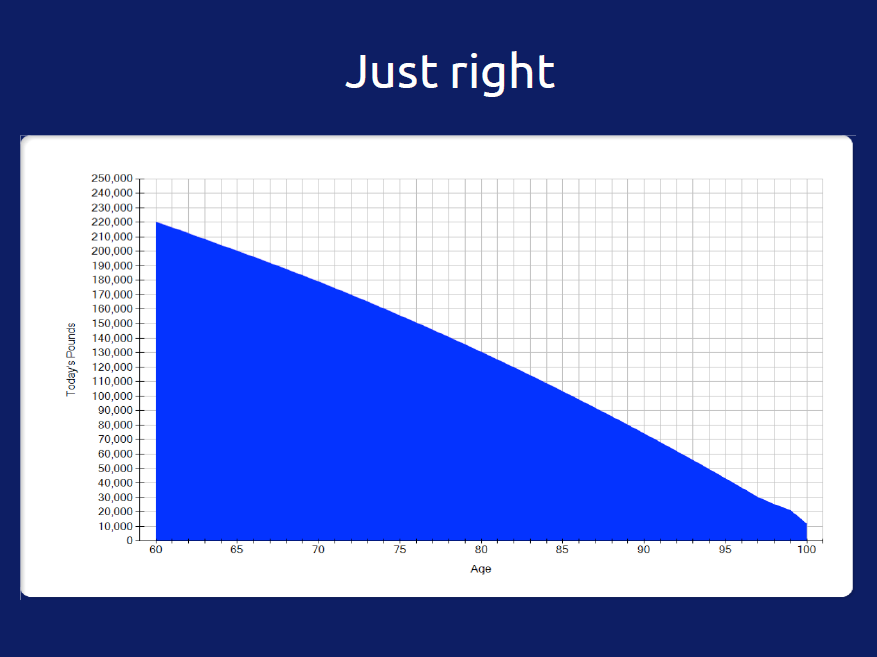

In other words, assuming a life expectancy of 100, we ideally want our money to last like this:

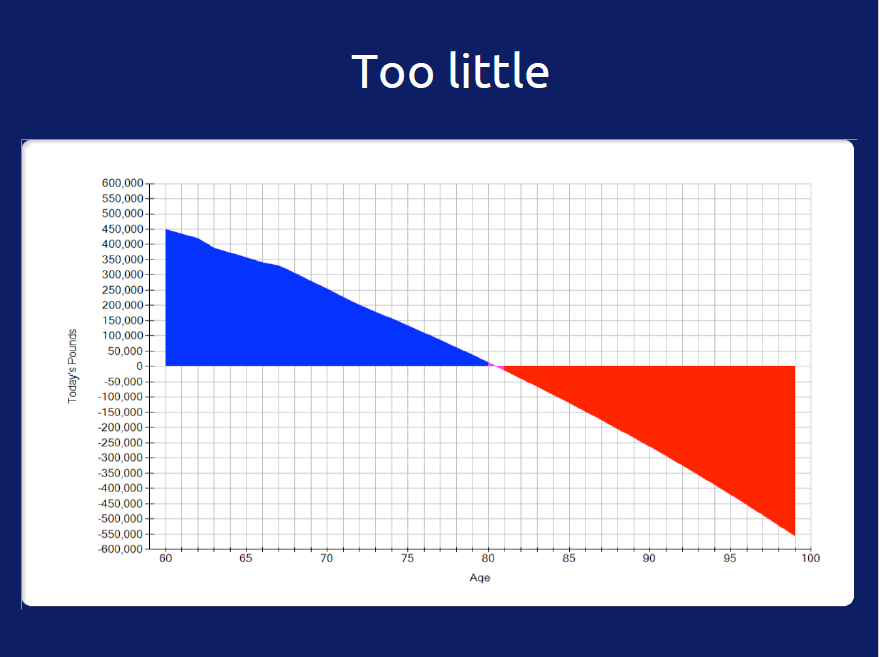

What we don’t want is a picture that leaves us destitute after aged 80, like this;

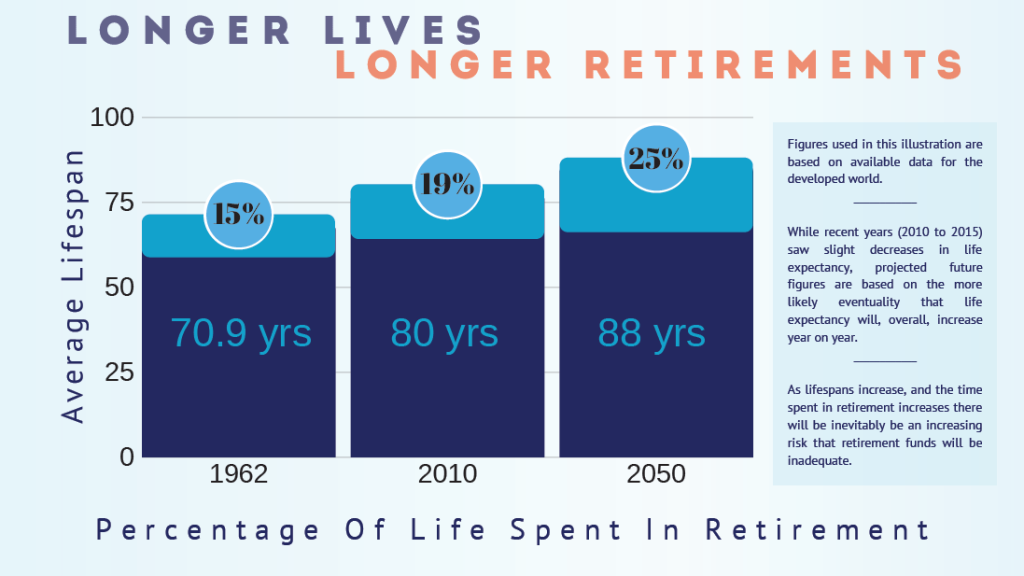

If age 100 feels a little optimistic it is important to remember that life expectancy, on the whole, is increasing over time as factors like health care, technology, and access to healthy food and clean water improve.

Recent estimates suggest that the average lifespan in the developed world will be around 88 years by 2050, with 25% of those 88 years spent in ‘Retirement’. You can play a whole lot of golf in 22 years!

Changes to the way we live, how we earn, our levels of fitness over time, and what we do during our lifetimes to gain fulfillment has led to considerable mindset changes on the idea of what ‘retirement’ actually is.

Rather than being viewed traditionally as the period after we stop work dedicated to a life of leisure, ‘retirement’ is often seen as an opportunity for change, allowing us to focus more on what we want to do rather than what we have to do.

For some, that means changing the way we make a living during our twilight years, rather than stopping altogether. In fact, many say they plan to make that lifestyle shift way ahead of ‘retirement’, further blurring the lines on what is traditionally viewed as ‘retirement age’.

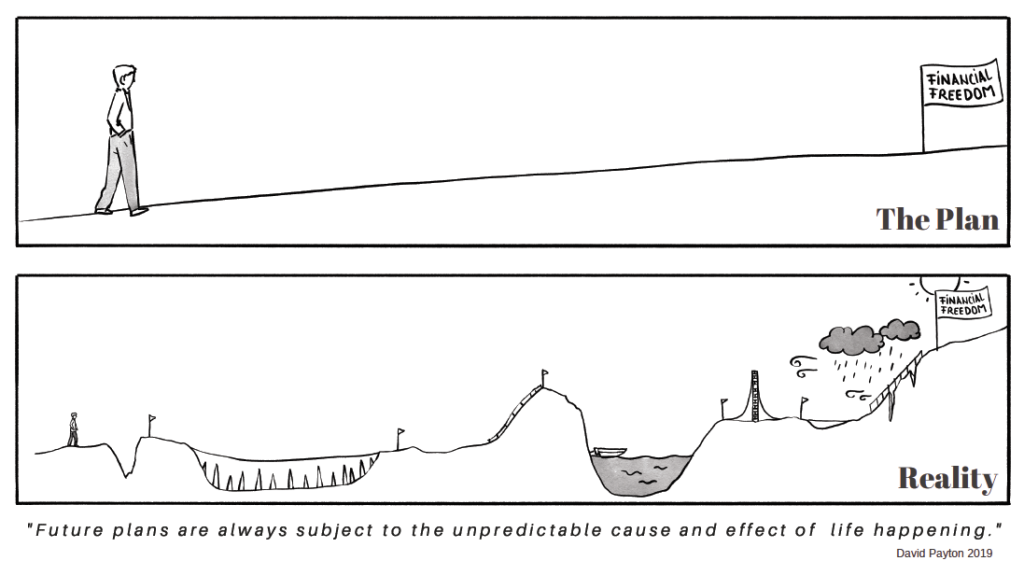

Whatever your plans are, a lot can happen on route to achieving your desired lifestyle, whether that be traveling the world with a laptop and a camera, or spending a quarter lifetime teeing up on the Algarve.

It does, however, seem to be a fact of life that the route you intend, is rarely how things pan out.

Key retirement factors to consider

Deciding how much you will need to fund your desired lifestyle, and balancing that against what you can afford to live on now to determine the amount you can comfortably save towards what you’ll need to fund your future, is the primary concern.

But how do you plan a secure retirement when you don’t know all the variables that may come into play between now and when you make that change?

- How do you decide what you want to do and when you want to do it?

- How would losing a partner impact you?

- What significant costs might you incur down the line, like education fees, weddings, helping your children with house deposits?

We believe a practical, logical, consistent, considered, and repeatable approach to Financial Planning is key to a successful outcome here. An approach that continually reviews your plan to take account of any bumps in the road, and ensures alignment with both your current lifestyle and future lifestyle plans.

This is what our Lifestyle Financial Planning Service offers, and is designed to use state of the art technology to help us, help you, deal with whatever life throws at you, and still stay on track.