With the legality of the referendum still being called into question. There is also the real possibility of a UK departure from the EU having to be approved by Parliament. Brexit may still potentially not be enacted.

All of which leaves the situation for both British residents and expats in relative uncertainty.

So what are the likely key factors that might impact your savings as an expat?

Exchange rates

When Brexit was announced, the value of Sterling dipped. When the possibility of a Brexit annulment was announced, the exchange rate for Sterling climbed.

Given this apparent link between the exchange rate and Brexit announcements. It is reasonably safe to assume that, should Article 50 be triggered, the pound is likely to slip further.

If you are based in Europe and are planning to move back to the UK then a weak pound presents a good opportunity for transferring funds.

Conversely, if you have savings you want to move out of the UK then a weak pound is likely to have a negative impact.

Deutsche Bank predicts the pound will be worth $1.15 by the end of 2016, which would be a 25-year low.

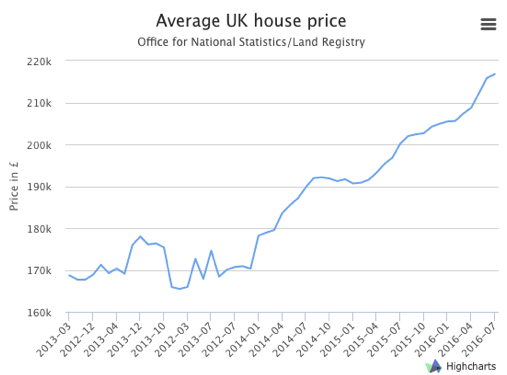

Property market

Currently, the housing market seems to have been untouched by the Brexit result. Samuel Tombs, Chief Economist at Pantheon Macroeconomics, warns against taking the numbers as a guarantee for future growth. He says prices “don’t reflect the full impact… because it takes several months to complete a house purchase”

Given the relative instability of the property market, it is a good idea to ensure you hold investments elsewhere to protect against a sudden market drop.

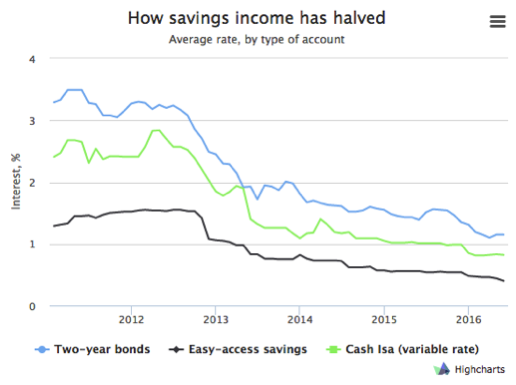

Fall in interest rates

A fall in saving rates is also anticipated as we move forwards through Brexit. Interest rates are already low. This is great for mortgage payments but makes saving in a traditional savings account relatively ineffective. Many interest rates are now below the rate of inflation.

While Brexit isn’t the cause of this trend, as the graph below shows, it is unlikely to have a positive effect, and interest rates are not set to improve in coming months.

There is always a risk that interest may, in effect, become negative, as seen in Japan and Switzerland.

Essentially, this means that savers are charged for holding savings rather than paid interest. This is a disincentive to save in an effort to encourage spending and boost the economy; of course, it doesn’t work as savers simply move the money to alternative investment vehicles.

It is likely that UK banks will do everything they can to avoid this situation, but we might see charges levied elsewhere so that banks can afford to offer interest rates on savings.

Dealing with uncertainty

There is no doubt these are challenging times when it comes to managing your investments.

The Brexit result was a surprise to many and now, with the legal validity of the result being challenged, the situation is unlikely to calm anytime soon.

When dealing with uncertainty it is important to retain as much control as possible.

The advantage of being an expat is that you have many choices over the location of your investments and the currency you invest in.

It has always been important to ensure all your eggs aren’t in one basket. Diversifying your investments increases in importance in times of economic and financial uncertainty.

Safety for your UK based savings

In the event of financial difficulty for a UK registered financial institution, the government confirms they will continue to protect savings of up to £75,000 per account per person.

There was initial concern that, as the EU set the threshold, the limit might be reduced to the 2010 amount of £50,000. Fortunately, this will not be the case.

Despite this good news, given the overall instability in the UK, it continues to make sense to diversify your investments. This will minimise risk should any of the banks run into financial difficulty.

Pensions

The impact of Brexit on your pension will largely depend on what kind of pension you have and how close you are to retirement.

Currently, those least prone to fluctuation are public sector pensions that have a guaranteed pension sum. Regardless of whether Brexit actually happens, pension sums are protected.

Those who have invested heavily in gilts are most likely to be affected. Whilst these are a secure investment, rates are currently low. Your investment is likely to have a low yield. It is also unlikely that Brexit, given economic forecasts, will improve this situation.

Should you be retiring in a few years and have high-risk stocks, or stocks heavily indexed to the European stock market, it would be worth reviewing your portfolio. Given the likely instability over the next few years you will probably want to diversify your portfolio and reduce your risk exposure. This will help you to avoid an unexpected drop just before your planned retirement date.

There is also the consideration that Brexit may trigger the withdrawal of QROPS and QNUPS options for expats. These accredited overseas pension schemes are a great way of protecting pension income against exchange rate fluctuations and changes to pension regulations.

Brexit may cause these options to be removed completely for British expats, or qualifying territories to be reduced.

Next steps

Fortunately, there are a number of steps that you can take to counterbalance market instability.

For exchange rates using a trusted provider such as Aston Currencies or IFX, is a great way to ensure you get the best exchange rate on the market.

Working with dedicated providers is also an excellent way of fixing an exchange rate for fixed sum transfer. Should you want to purchase a home abroad with your UK savings you may want to agree an exchange rate now. This can protect you from any additional drops in the value of Sterling.

Given that UK based fixed rate saving account rates are poor it is worth investigating other options available to you. Depending on your tax residency status there may be more interesting avenues to explore. We recommend contacting your Financial Adviser to discuss this in more detail.

If you are an expat with long-term plans to move back to the UK, you might want to consider converting some of your savings into sterling now to take advantage of the low exchange rates. As the referendum vote may be overturned, there is always the possibility that exchange rates increase in the coming months.

Discuss your financial options with one of our Wealth Managers to understand where is the best place is to invest your money.