Unless you are “independently wealthy”, you will need to save on a regular basis to afford to fund life events like children’s education, children’s wedding/property expenses, and retirement.

The goal is to try and achieve the lifestyle you want while saving towards your future life events. If you don’t, years from now, you may kick yourself, and wish you had put something away.

How does a savings plan typically work?

When you invest, your minimum target should be to beat inflation each year. Because the cost of living increases every year, inflation is a crucial factor to consider, and your savings plan should try to beat it by setting a minimum target to better inflation year in year out.

Inflation rates vary between countries but the global average at the time of writing is 3% a year. To beat inflation, you and your financial adviser should choose a range of funds that have historically performed above the rate of inflation, and a product that uses compounded growth. This approach is preferable to keeping money in a bank where, in real terms, you lose money every year as the rate of inflation eats into the buying power.

Historically, over the long term, funds outperform all other asset classes including, cash, bonds, property, and commodities. A fund simply holds an extensive collection of different equities that, because you buy into the fund, you then own part of. A fund can offer the diversity you need to ensure your “eggs” are not all in the same basket.

Having said that funds are an efficient way to go, it’s wise to bear in mind that past performance of individual funds is not a guarantee of future performance. It is impossible for anyone to predict which investments will deliver the best returns every year into the future, but creating an investment portfolio diversified across different asset classes and geography allows you to maximise returns, and reduce risk.

It is important to note here though that you are saving for life events long in the future. These are long-term investments that performs over time. This type of investment is NOT intended, and should never be viewed, as a short-term investment you can access to pay for that new kitchen or a new car.

Your adviser can help you to find suitable products you can use to save for retirement and those that are suitable for saving for life’s other expenditures, like that new kitchen or new car.

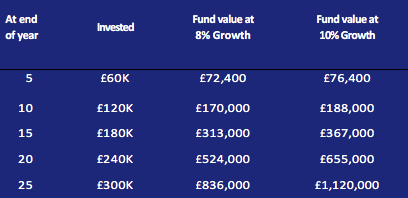

For illustrative purposes only, the table below shows the average returns for a typical savings plan over twenty-five years for a forty-year-old wishing to retire at age sixty-five contributing £1,000 per month;

A typical regular savings plan also invests your money so that your investment takes advantage of ‘cost averaging’. Cost averaging is a method that uses regular savings contributions to help smooth out investment volatility. The critical point about cost averaging is to invest an amount on a regular basis.

This is how it works; when prices are high, the regular contributions buy fewer units of the funds, but when prices are low the contributions buy more. Over the long term, as the fund goes in an upward direction, this strategy increases the average value of each unit purchased thereby improving overall returns. Saving regularly, and using cost averaging, takes away worry about when the best time is to invest.

For this approach to work, it’s crucial to have time in the market and not try to time the market. It’s very difficult to predict financial market movements and to get the exact timing of when to invest or disinvest just right, so saving steadily and regularly over time is key to ensuring success.

Before investing in any long-term plan we recommend talking to your financial adviser who can look at your circumstances and advise accordingly to ensure that your savings strategy fits your lifestyle expectation, goals, and overall financial planning model.

How much should I save?

As a rule of thumb, and depending on your outgoings and current disposable income (the amount left after all expenses), a healthy start to saving for your pension plan would be 10-15% of your current disposable income.

Your financial adviser will work with you to calculate how much you should be saving based on your preferred retirement age, income, outgoings, future plans, and lifestyle preferences.

Once you and your adviser have calculated your optimum regular savings goal, the next step is to minimise your contribution and maximise the return on your savings by selecting the most appropriate savings plan(s) or investment vehicle(s). Your adviser can help you by demonstrating how, by investing smartly, you can reduce your contribution dramatically and still achieve the same outcome and much sooner.

So, when is the best time to start saving?

Well, the short answer is ‘right now!’ Why? Because the earlier you start, the less you have to invest to achieve the same outcome!

For the years you could have saved, you’ve already lost substantial compounded growth and time in the market. We’re all living longer, however, with life expectancy now over eighty for both men and women it’s not unreasonable to say that if you start investing now, you stand a chance of regaining some of that loss.

For more about financial planning best practices, download our free Financial Planning Best Practices Guide.