The Monkeys Paw – A tale of unintended consequences

Originally written in England in 1902, the Monkeys Paw tells the tale of unintended consequences.

The owner of the paw is able to make three wishes, that will come true, but the curse of the paw is that the wishes come at a personal cost. Mr. White is the main character in the tale and wishes for £200 to pay off his mortgage. His son is killed in an accident at work and Mr. White is duly compensated for his loss, to the tune of £200.

The moral of the story is that whilst we may often wish for things, we don’t always think about the unintended consequences of acquiring them.

For example, investing heavily in one type or stock or asset, may give you the desired returns in the short term. However, a common unintended consequence is that the stock is hit with a shock affecting that market sector, and loses you large sums of money. A case of putting all your eggs in one basket and most definitely not what you wished for! This is why sensible advice always guides you towards diversification.

Unless you have a particular penchant for risk, or want your portfolio to forever bear the curse of the Monkeys Paw, then considering a well-diversified portfolio gives you a much better chance of a decent return on your investment, and of achieving your wish!

Sleepy Hollow – casting a spell over the minds of good people

The legend of Sleepy Hollow is one of the earliest examples of American Fiction and was first published in 1820. A haunting and bewitching atmosphere pervades the secluded glen of Sleepy Hollow, and seeps like tendrils of mist into the imaginations of both inhabitants and visitors. Here, the town is fueled and ruled by the legend of the Headless Horseman.

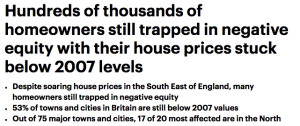

In much, the same way as the Headless Horseman rules hearts and minds in Sleepy Hollow. The legend that property is the ultimate investment opportunity, rules across many peoples from many lands in our own society. Whilst, there may be good reasons for investing in property, whether you should depends on your financial objectives and long-term goals rather than the stuff of legend. Keeping your head whilst everyone around you loses theirs may very well mean you win the battle with a decent portfolio driven by sound thinking, whether it includes bricks and mortar or not.

Property, much like the Headless Horseman, should be approached with caution.

Its perceived long-term performance is subjective; open to personal interpretation and emotional steering in a way that other investments are not. Sudden shocks in the market can leave you trapped in your own negative equity; stuck in Sleepy Hollow when you’d most like to escape!

Dracula – unexpected attack

Dracula is one of the most popular characters created in horror fiction, except that he was based on a real character with a taste for blood; Vlad the Impaler. Whilst there is no evidence that Vlad was a Vampire, he certainly developed a reputation for cruelty. What makes Dracula so terrifying is that he could strike at any time. The fact that he is partially based on a real character adds a certain dimension of reality that is hard to escape.

This marriage of fear and reality becomes tangible when it comes to our health. Many of us fear that one day we will fall ill and be unable to work and provide for our families. The horror here is that many people take absolutely no action to protect themselves; ignoring the need for the garlic and the cross, so to speak.

Unexpected long-term illness can do serious financial damage and often strikes when we believe we are fit and healthy. The moral of the story here is ‘Don’t let Dracula get you’; arm yourself and your family with some effective health and medical coverage now.

The Pale Man – becoming obsessed about a permanent resident

The Pale Man is one of the shortest horror stories out there. So short, in fact, you can read it in full here, in under five minutes.

The story introduces us to the main character; a permanent resident in a country hotel. He becomes obsessed with the only other person he believes is also a permanent resident, follows his movements, and tries to meet him at all costs. We only learn towards the end of the tale that the narrator has made a terrible mistake about the origins of The Pale Man. He isn’t a permanent resident at all; he is death, and he has been slowly making his way towards the residents’ room.

‘Permanent residency’ can be a horror story in its own right if not managed correctly.

You may be physically resident in one location, but ‘tax resident’ in another. As in The Pale Man, it is very easy to become fixated on the wrong residency. Unfortunately, the moment of realisation can often come too late. For example, when a large tax bill arrives and you don’t have the liquidity to pay it, or when you are about to withdraw assets from a certain location. Don’t let these horrors happen to you. Speak to someone and get clarification on your residency status. Don’t end up trapped financially in the future.

We would never want to intentionally scare our clients and all of these horror stories can be easily avoided by seeking advice from a reputable source.