The problem with that, however, is that you make the mistake of selling when prices are low and buying at higher prices when markets inevitably rebound.

The worst thing you can do is to stop investing altogether as you want to stay invested for when markets improve.

Market volatility can in fact work to your advantage if you invest regularly by using cost averaging.

What is cost averaging?

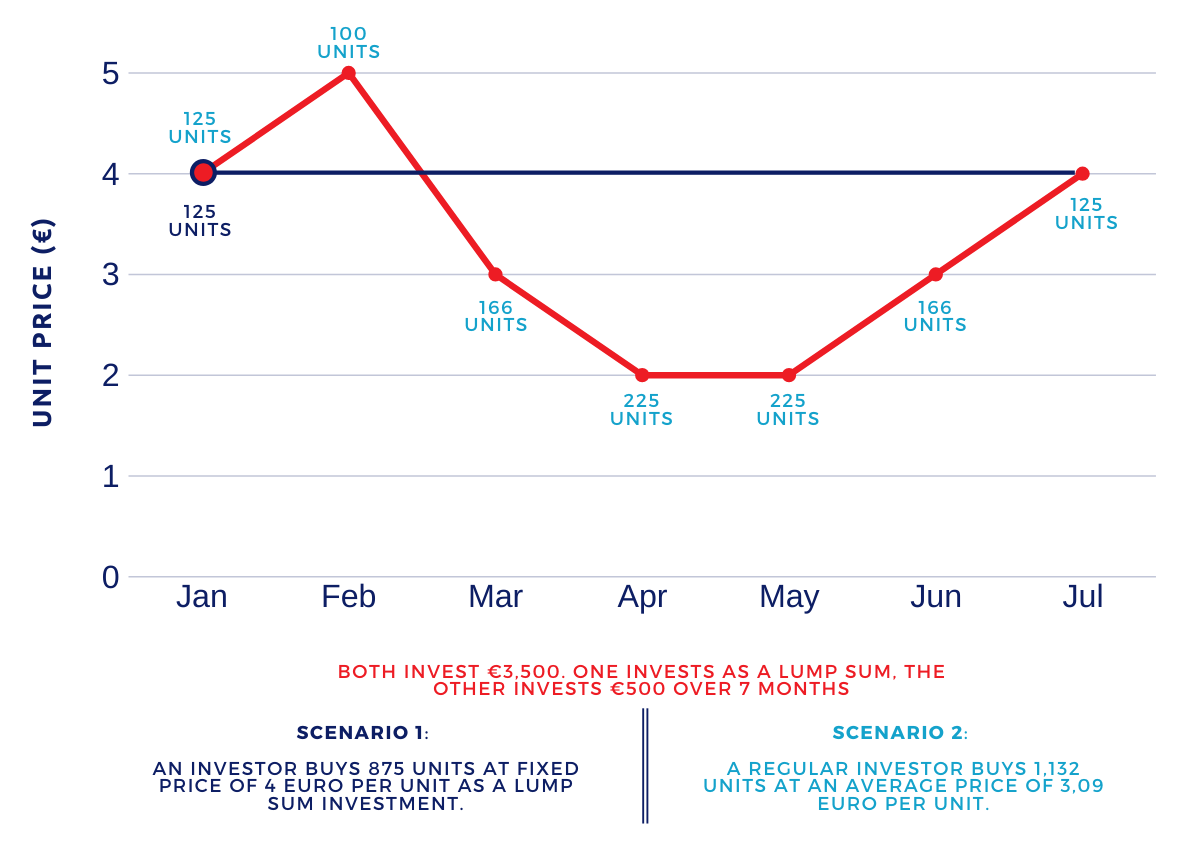

Cost averaging is a strategy where you invest the same amount at regular intervals, regardless of the share or unit price. As a result, you buy more shares or units when prices are lower and fewer shares or units when prices are higher.

It’s a conservative approach to investing but can have a powerful impact on your savings over the long-term because cost averaging ‘smooths’ your purchase price over time.

That is, you pay a lower average cost per share or unit and end up with a greater number than you would have had you invested a lump sum amount at the start of your investment period.

Staying invested is the most important thing you can do during a market downturn, as you have the opportunity to buy at huge discounts and be ready to maximise your growth for when the market rebounds.

The diagram below clearly explains the power of cost averaging:

The benefits of cost averaging

You control how much you invest and over what time horizon

By making regular purchases of the same share or unit at the same price each time, you have a greater chance of reducing the impact of market volatility on your overall investment.

Of course, it’s imperative to ensure that the amount you regularly invest is affordable to you; the amount should be based on your situation and your financial goals. This is where sound financial planning can help.

You don’t need to ‘time’ the market

Contrary to what some people believe, we can never really time the market. As hard as some investors try, it’s almost impossible to predict how the market will act in the future.

There will always be ‘black swans’, unpredictable events that impact the market in ways we can’t predict, such as the Covid-19 coronavirus pandemic.

For this reason, cost averaging is an investment strategy that can work to your advantage both when markets are volatile and during normal market fluctuations.

You can start small, so there is no need to invest all your money up front

Cost averaging allows you to ease into the market over time and slowly but surely build savings and wealth even if investing a small amount. The power of regular savings is just that – saving regularly to build wealth.

It takes the emotion out of investing

We are all human and can easily fall victim to making fear-based decisions especially when markets are particularly volatile. If you follow a cost averaging strategy, you will be buying shares or units when people are selling out of fear and panic. As a result, you buy when prices are low and set yourself up for stronger long-term gains.

In summary, cost averaging can help you to take advantage of a bear market rather than see it as a threat.

Next steps

If you would like to know more about cost averaging and what types of investments to target, please get in touch.