As the curtains rise on 2024, one event stood out last week: Nvidia’s earnings announcement. The anticipation surrounding this event was palpable, marking it as one of the most celebrated moments in the market this year. While Big Tech’s dominance is often credited to the “Magnificent Seven” stocks, this time around, the spotlight shines on three key players: Nvidia (NVDA), Meta (META), and Amazon (AMZN).

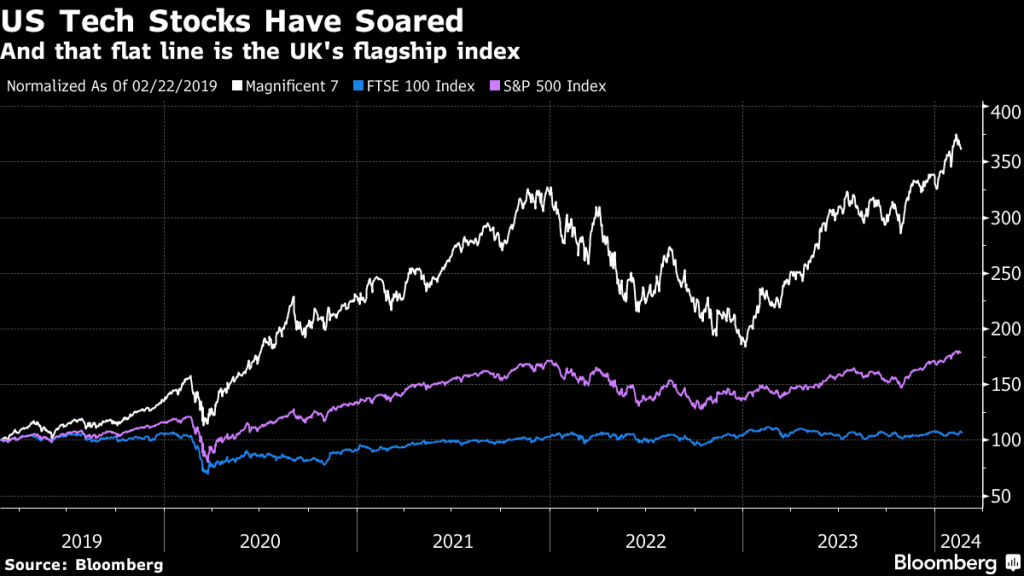

These three companies have not only outperformed the S&P 500 but have also surpassed their peers in the Magnificent Seven. Nvidia, in particular, has seen an astonishing surge of nearly 60% compared to the benchmark index’s modest 6% increase. This remarkable performance is a testament to the resilience and strategic foresight of these tech giants.

However, Nvidia’s journey to success hasn’t been without its challenges. In the lead-up to its earnings announcement, the company’s shares experienced a slight dip, sparking concerns among investors reminiscent of the technology stock market bubble of the late 1990s. Yet, unlike those profitless companies of the past, Nvidia’s results revealed impressive revenue growth of 22% over the previous quarter and a staggering 200% increase from the same period last year, with profits soaring to new heights.

Both Alphabet and Apple have faltered to outpace the S&P 500 on a year-to-date basis. Alphabet grapples with the aftermath of unexpectedly poor Q4 advertising revenue, while Apple contends with a slew of broker downgrades amid lingering demand concerns, particularly in China.

Yet, amidst this backdrop of fluctuating fortunes, one standout laggard commands attention: Tesla. Plagued by a myriad of challenges ranging from waning electric vehicle demand to persistent corporate governance woes, Tesla finds itself as the S&P 500’s worst performer, trading over 25% lower year-to-date.

In light of these developments, one is prompted to ponder whether the narrative of the “Magnificent Seven” remains apt, or if a transformation is in order. With the stalwarts facing headwinds and the market landscape evolving, the notion of a “Fantastic Four” seems to loom on the horizon, beckoning a reevaluation of market dynamics and the forces that shape them.

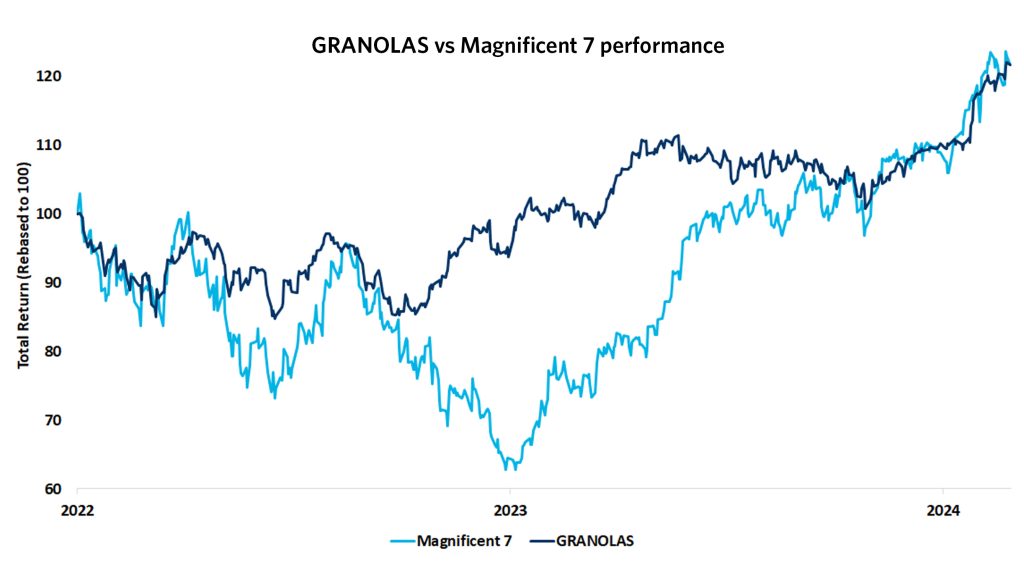

Meanwhile, amidst the hype surrounding the “Magnificent Seven”, another group has quietly been making waves: the GRANOLAS. Consisting of GSK, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, LVMH, AstraZeneca, SAP, and Sanofi, these companies have not only outperformed the Magnificent Seven over the past two years but have done so with significantly lower volatility.

The resilience of these companies, bolstered by stronger balance sheets and adaptable business models, underscores the importance of diversification and strategic investment decisions in today’s uncertain market environment. While the Magnificent Seven may dominate headlines, it’s essential not to overlook the steady performance and potential of the GRANOLAS.

In conclusion, as we navigate the complexities of the market landscape, it’s crucial to remain vigilant, adaptable, and informed. Whether it’s the rapid rise of tech giants like Nvidia or the steady performance of stalwarts like Granola, understanding market dynamics and making strategic investment choices is key to long-term success. Through active management, diversification, and a patient outlook, investors can navigate the complexities of the market with confidence.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity.