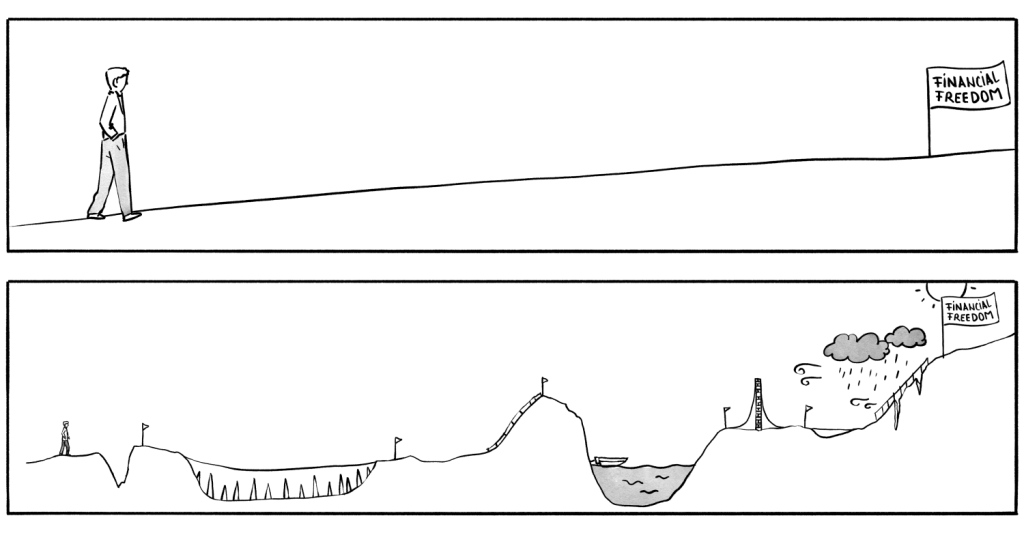

So, you’ve set your financial goals, worked out what you’ll need to do to make sure you achieve them, and mapped out your route and the milestones you’ll need to hit on your journey. Job done. Time to sit back and enjoy the returns of your hard work!

But is it really as simple as that? What happens if something alters your trajectory?

Everything Changes

They say ‘people never change’, but that’s not entirely true. We all change, just a little, every day. Sometimes the changes are so incremental we don’t even realise it’s happening until we really take stock and look back.

We’re influenced by the river of life flowing around us, by who accompanies us on our journey, and who we meet on our way. We never really know with any absolute degree of certainty what that river has in store for us downstream.

What might be right for you now, may not be a year or two, or ten, in the future. When it comes to plans, especially financial plans, where you thought you might want to end up when you made your plans may not mirror your aspirations now or in the future.

Perhaps, when making our plans, we didn’t have a partner or didn’t have the same partner. Maybe we didn’t have a family, or perhaps evolving circumstances has settled us in a completely different part of the world than we expected.

So, we’ve changed. Then we look at the financial goals we set, and we’re still doggedly trying to achieve them because, well, it’s our plan. Even though it no longer reflects our current reality.

The Right Financial Goals

The truth of the matter is that, while many people set goals, on average, they only actually attempt to reach them once. Take those new-year resolutions, for example – how many people do you know who make them, and how many do you know who actually act on them.

Those who do reach their goals typically attribute their success to setting achievable, tangible, measurable objectives, and pursuing them with focus and determination, even when faced with challenges. These individuals tend to recognise the importance of being flexible in how you pursue your goals over time. Essentially keeping your eye on the prize while overcoming perceived obstacles, and altering your method of attack according to the prevailing terrain.

People who set and reach their goals possess a tenacity that has enabled them to define their own lives. They view their wealth and financial stability as having less to do with a balance sheet and more to do with a balanced life.

Ask Yourself the Difficult Questions

Rather than having no plan at all or doggedly following a plan that no longer represents your needs, instead, take time to ask yourself questions like:

- Am I still on the right track, and is this what I really want?

- Have I spoken with my partner or adviser about my financial plans recently?

- What matters most to me? Has this changed?

- Do I need to change my goals, and can I afford to do so?

- How did I calculate my retirement age? Is this still the right goal?

- Have I calculated everything correctly, and do my calculations still make sense?

Differences Matter

It’s about recognising the differences between your current and envisioned lifestyles and having a robust plan for moving from one to the other. Your financial goals should always be aligned. This means building in regular review and forward planning processes, so you can incrementally adjust your plan to make sure it remains relevant to who you are now and your current financial position.

We recommend a review and forward planning meeting at least once a year. If you have a partner, it’s a good idea always to include them in this process.

Use your annual planning and review to keep on track by asking the hard questions, being honest about where you are and where you want to be.

Every time you forward plan, always double-check your figures to make sure the math is correct. If you’re not sure, speak to your adviser to ensure your anticipated returns match reality.

We also recommend reading our blogs where we talk about key considerations for later life planning, planning for an uncertain future, and why happy couples talk about money.