Regardless of your personal experience with this tool, ChatGPT’s impact on industries and jobs is undeniable. ChatGPT offers a remarkable opportunity for individuals to gain key retirement advice effortlessly. Its accessibility and user-friendly interface provide a comfortable environment for users to seek financial guidance. For those without immediate access to financial advisers, ChatGPT fills a crucial gap by offering valuable insights and information.

At United Advisers Group, we embarked on an experiment to assess ChatGPT’s suitability for financial planning. Our goal was to determine if AI could outperform our human advisers in providing advice to our clients. During our evaluation, we discovered that ChatGPT excels at number crunching, especially in terms of speed, but it is still highly dependent on the input of information. It also fell short when it came to forecasting changes in interest rates and personal finances over an extended period, such as the impact of a larger salary or altered expenditures on retirement planning. The calculations generated by the AI proved to be significantly inaccurate.

ChatGPT lacks the ability to ask all the nuanced questions that a human adviser can. It might provide a savings goal, but it cannot offer personalised advice on pre-tax or after-tax retirement accounts or investment strategies. As David Cooper, Director of Wealth Management at United Advisers Group wisely points out, “A human adviser can identify the elements you did not think to plug into your ChatGPT equation.” The significance of emotional intelligence (EQ) in financial planning cannot be overstated. Employing advisers with high EQ enhances communication, leadership, productivity, customer service, and decision-making. A human adviser brings a level of empathy, understanding, and foresight that AI currently cannot replicate.

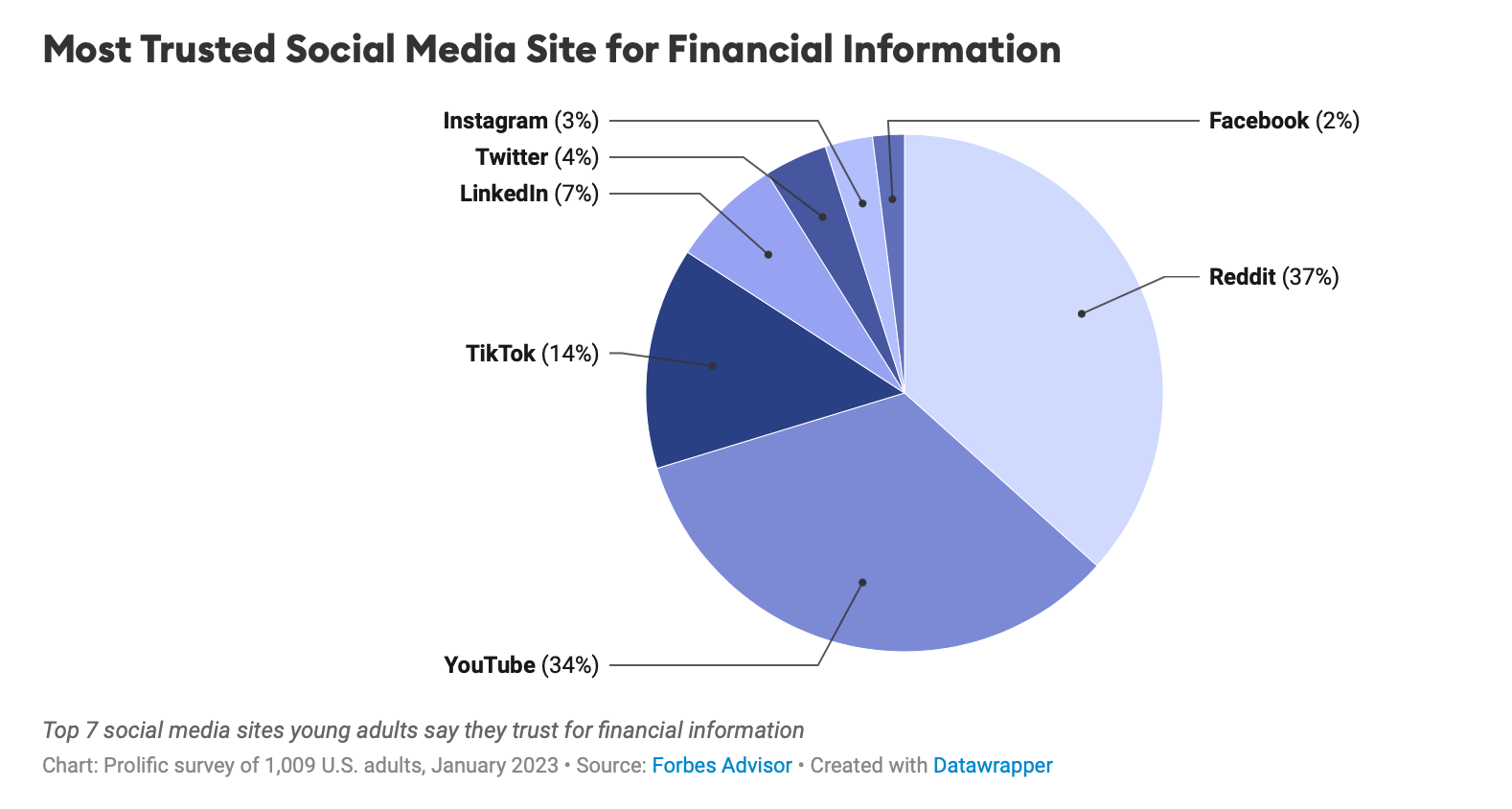

Currently, not just ChatGPT is used for financial advice, but also social media channels. An astonishing 79% of American millennials and Gen Z seek guidance through these platforms. 21% of young Brits get investment tips from Instagram and 16% from Facebook. No one over 55 uses the social media platform for ideas for their portfolio. While social media can enhance financial literacy and empower individuals, it is crucial to recognise its limitations. As James Maxwell, a Senior Wealth Adviser at United Advisers Group, emphasises, “Anyone can post anything online without consequence—including bad or inaccurate advice about money management.” This stands in stark contrast to the stringent regulations governing financial advisers. This regulatory framework serves as a vital safeguard for clients seeking reliable financial guidance. Although social media has made financial advice more democratic, at the same time, social media-driven financial scams are on the rise.