Financial freedom means different things to different people. For some, it means meeting their monthly financial commitments with spare money for spending as well as having a solid savings and investment plan. For others, financial freedom means quitting employment to be their own boss or being financially comfortable enough to consider early retirement.

There’s no one definition of financial freedom, or financial independence as it’s otherwise known. However, being financially free means you’re in a position to make important life decisions without worrying about the future financial impact.

What are the main benefits of financial freedom?

There are many benefits to achieving financial independence. The following are our top six:

- live and work on your own terms

- greater financial security

- unemployment insurance

- extra investment power

- early retirement

- peace of mind.

We recently delved into greater detail about each of the top 6 benefits of financial independence. Ultimately, however, financial independence provides freedom of choice, which is why so many of us strive to achieve it.

The key principles for achieving financial freedom

We know that while many people are striving for financial freedom, very few actually get there. Whether it’s lack of time, lack of knowledge or lack of having a financial plan, there are many reasons for why few people achieve financial independence.

Have a plan and set goals

If you don’t understand where all of your money is going, or you have trouble controlling your spending, you will find that financial freedom is almost After learning how to manage your money and track your spending, set some financial goals specifically related to your personal circumstances.

Save proportionally to your income

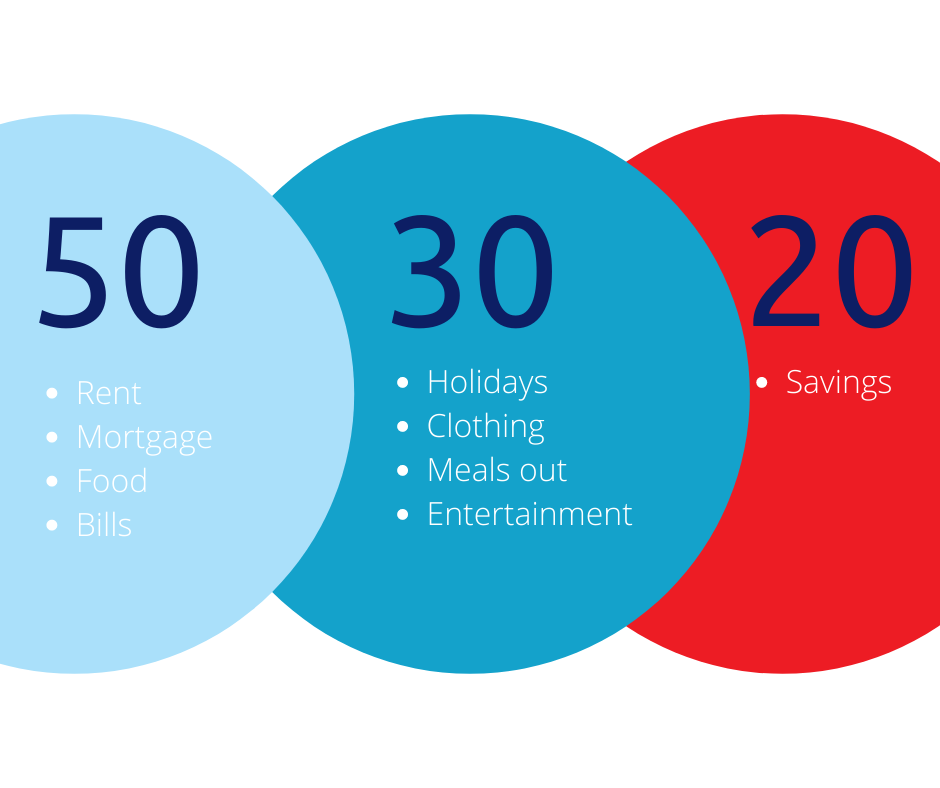

There are many finance and budgeting sources that say you should aim to save at least 20% of your income every month. There’s a popular 50/30/20 rule that states you should put aside 50% of your income for essentials like rent/mortgage, food and bills, 30% for discretionary spending and 20% for saving. However, it’s not always that simple. If saving 20% just isn’t possible right now, saving something is better than nothing.

If you’re a higher earner, or a DINK household (dual income, no kids), then you may have a much higher savings potential. There is a growing trend of saving 50% of the household revenue, or one salary, within these types of couples. Aggressive savings strategies, especially early on, can quickly generate an impressive investment portfolio which can fund early retirement or dramatic career changes.

Review your expenses methodically

Reviewing your monthly income and calculating that against your monthly expenses can give you a benchmark figure for your savings goal. Doing this will also help you identify any cash flow challenges and/or opportunities. The goal is to always have less cash leaving your accounts and more going in, putting you in the strongest financial position.

If you are in a couple or another relationship where you share finances it is important to do this exercise together. There has been a significant amount of research suggesting that couples who regularly talk about money and financial goals are happier.

Pay off debt first

Your mortgage is likely your biggest monthly expenditure. Make extra monthly payments toward the principal balance to reduce interest and gain more equity. Also make a list of all other debt excluding your mortgage, such as credit cards and car loans. List those debts in order from the smallest to largest amount in terms of interest accrued. Regardless of whether you have a €20,000 loan at 5% and €1000 credit card debt at 10%, the €1000 comes first on the list.

Make the minimum payments on all your loans except for the one costing you the most – pay as much as you can every month on that loan. Once it’s paid in full, redirect the money you were using to pay it off every month towards paying off the second debt. Continue like this until all are paid in full.

Build a passive revenue stream

Passive income streams can generate a predictable income with little maintenance. Of course, you first need to save enough to build your passive revenue streams, such as buying a rental property or investing in stocks and bonds. However, once you have enough passive income, you are freer to do what you want, and you will expedite your journey to financial freedom.

Don’t upgrade your lifestyle at the expense of saving

As you land better-paying jobs and advance through the years, it’s only natural that you will add material items and experiences to your life. For example, purchase a bigger house or take more holidays. However, be aware of lifestyle inflation. Avoiding it means that when you receive a salary increase, don’t automatically increase your spending. Instead, make plans for how to use that money wisely and further build your financial security. When you forecast an income increase, how does that impact your retirement plans? Could you afford to retire early?

Review your lifestyle and expenses more than once

If you want to really take control of your financial future, you need to consistently review and update your expenses. This could be weekly, monthly or quarterly. The goal is to be consistent. Regularly reviewing your expenses helps you to better manage your spending habits, increase your savings and make progress towards your financial freedom goal. If you were to review your expenses only once and take a ‘set-and-forget’ approach to your personal finances, you would have no way of tracking your progress.

Diversify your investments

Investments come with risk, but you can manage your risk by diversifying your investments across different asset classes. Markets can be unpredictable and volatile. By diversifying your portfolio, you are increasing your odds of investment success and long-term financial gain. And always choose investments that match your tolerance for risk. Don’t follow the crowd when it comes to choosing what to place in your investment portfolio.

Have an emergency fund

Building and maintaining an emergency fund is one of the most important things you can do as part of your savings plan. It will also keep you on track to reaching your financial goals by providing a safeguard should you be faced with an unexpected situation. A general rule says that you should aim to have 3–6 months’ salary in your emergency fund. It’s best to put your emergency fund money into a dedicated and separate bank account. That way, there’s less temptation to access the money for everyday needs or wants.

Protect yourself

As well as protecting yourself with an emergency fund, protect your means to keep saving and until your passive income is secure. This will depend on where you live but ensure you have enough insurance coverage. As you begin to build wealth, you want to ensure your progress isn’t derailed by an unexpected health issue or sudden loss of income. Invest in quality health coverage and make sure you have sufficient income protection, homeowner’s and life insurance. This is an important part of setting yourself up for financial independence.

Get started

It’s often difficult to find the time to tackle financial planning. However, doing so will help you to maintain the lifestyle you envision and achieve your financial freedom goal.

To learn more about how you can benefit from our dedicated Lifestyle Financial Planning service, download our free Lifestyle Financial Planning guide.